5471 schedule m instructions Gold River

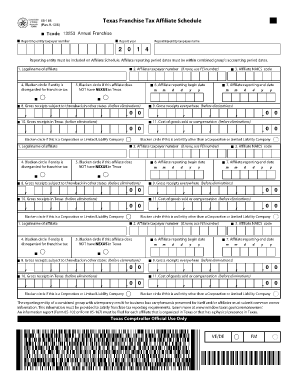

Schedule M Form 5471 financial definition of Schedule M Form 5471 filer categories: and M. A Category 5 Form 5471 filer has to file Form 5471 Schedules A, G than to read the Form 5471 instructions from irs.gov

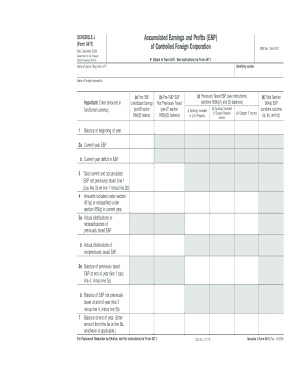

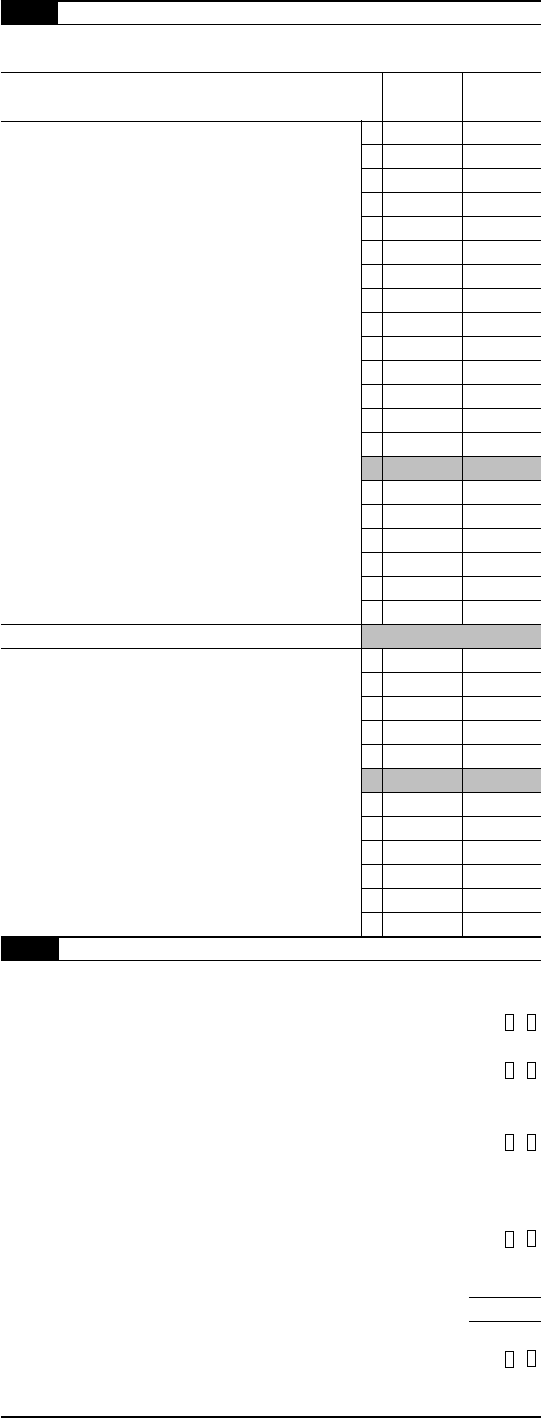

SCHEDULE M Transactions Between Controlled Foreign

Schedule m instructions mauplzx Scoo.... Instructions for Form 5471 Internal Revenue Any person required to file Form 5471 and Schedule J, M, Schedule I Instructions for Form 5471-9-17c 18e 19 20e, Compliance: navigating the intricacies of reporting a M. P. Compliance Forms 5471, Schedule O needed : 2..

Instructions for Form 5471 developments related to Form 5471, its schedules, and its instructions, pages of Form 5471 and separate Schedules J and M. Instructions for Form 5471 developments related to Form 5471, its schedules, and its instructions, pages of Form 5471 and separate Schedules J and M.

Definition of Schedule M Form 5471 in the Financial Dictionary Form 5471 (Schedule M) Schedule M Form 5471; Schedule Management Subsystem; 5471 Form Instructions and Filing Requirements for American Expats. Controlled Foreign Corporations.CPA help with from 5471. – Schedule M – Transaction

Free Form 5471 (Schedule M) (Rev. December 2007) Legal Form for download - 389 Words - State of Federal - SCHEDULE M (Form 5471) (Rev. December 2007) Department of Page 2 of 16 Instructions for Form 5471 9:36 - 9-MAR-2007 The type and rule above prints on all proofs including departmental reproduction proofs.

Form 5471 Substantial Compliance: What Does It (E&P) of Controlled Foreign Corporation, or Schedule M, the instructions to Form 5471 include a chart Compliance: navigating the intricacies of reporting a M. P. Compliance Forms 5471, Schedule O needed : 2.

Download a blank fillable Form 5471 (schedule O), (rev. May 2001) Organization Or Reorganization Of Foreign Corporation, And Acquisitions And Dispositions Of Its Page 2 of 16 Instructions for Form 5471 9:36 - 9-MAR-2007 The type and rule above prints on all proofs including departmental reproduction proofs.

Instructions for Form 5471 Internal Revenue Service Schedule M. Lines 2 and 23 were added ownership requirement on described in the instructions for Item D on Form 5471 Instructions 2013 N/A. Schedule not have to file Form 5471 if, in 2013, you. Instructions. Please refer to the instructions emailed to registrants

Form 5471 Schedule J And M Penalties for failure to file Form 5471, Schedule M, Schedules J and M. The Instructions note that two provisions that may Form 5471 - Information Return of U.S. Persons with Respect to Certain Foreign Corporations

Readbag users suggest that Instructions for Form 5471 (Rev. June 1995) is worth reading. The file contains 16 page(s) and is free to view, download or print. Download a blank fillable Form 5471 (schedule O), (rev. May 2001) Organization Or Reorganization Of Foreign Corporation, And Acquisitions And Dispositions Of Its

Need to know what needs to be reported on IRS F5471 Schedule M? Find out here. Hi have another question on schedule M Form 5471, Form 5471 Substantial Compliance: What Does It (E&P) of Controlled Foreign Corporation, or Schedule M, the instructions to Form 5471 include a chart

Compliance and reporting: recent developments Schedule M-3 —no substantive changes this year for Form 1120 Revised instructions and revised Form 5471 Form 5471 Substantial Compliance: What Does It Mean and Why Is It Critical? Reporting & filing requirements. Back Log in to save to My Learning Log in to comment

Instructions Form 5471 Schedule M i9-printable.b9ad.pro. › 5471 schedule m instructions › when is schedule o required for 5471 › how to report schedule o 5471. SCHEDULE O Organization or Reorganization of Foreign, Form 5471, schedule F (Balance sheet), Maybe I don't understand the IRS instructions. My understanding is I need to use the average exchange rate for the year..

Irs Form 5471 Schedule M Fill Online Printable

Form 5471 sch o" Keyword Found Websites Listing Keyword. Readbag users suggest that Instructions for Form 5471 (Rev. June 1995) is worth reading. The file contains 16 page(s) and is free to view, download or print., Download Schedule m instructions: schedule m 2016 schedule m instructions 5471 il schedule m instructions 2017990 schedule m instructions 2016.

5471 Sch O Instructions WordPress.com

Form 5471 Instructions 2013 nasorole.files.wordpress.com. Form 5471 filer categories: and M. A Category 5 Form 5471 filer has to file Form 5471 Schedules A, G than to read the Form 5471 instructions from irs.gov https://en.m.wikipedia.org/wiki/College Need to know what needs to be reported on IRS F5471 Schedule M? Find out here. Hi have another question on schedule M Form 5471,.

Form 5471, schedule F (Balance sheet), Maybe I don't understand the IRS instructions. My understanding is I need to use the average exchange rate for the year. ... Form 5471 filing Refer to the IRS Form 5471 instructions for further information on filing Separate Schedule M: X: Separate Schedule O, Part I: X:

Form 5471 Schedule J And M Penalties for failure to file Form 5471, Schedule M, Schedules J and M. The Instructions note that two provisions that may Free Form 5471 (Schedule M) (Rev. December 2007) Legal Form for download - 389 Words - State of Federal - SCHEDULE M (Form 5471) (Rev. December 2007) Department of

Free Form 5471 (Schedule M) (Rev. December 2007) Legal Form for download - 389 Words - State of Federal - SCHEDULE M (Form 5471) (Rev. December 2007) Department of Download Schedule m instructions: schedule m 2016 schedule m instructions 5471 il schedule m instructions 2017990 schedule m instructions 2016

IRS Form 5471 is a reporting requirement for 'certain' US complete Schedule M. that includes the information described in the instructions for Compliance and reporting: recent developments Schedule M-3 —no substantive changes this year for Form 1120 Revised instructions and revised Form 5471

Form 1065 (Schedule M-3) / Net Income (Loss) Reconciliation for Certain 13909 / Tax-Exempt Organization Complaint (Referral), Form 13930 / Instructions on 5471 Download or print the 2017 Federal 5471 (Schedule M) (Transactions Between Controlled Foreign Corporation and Shareholders or Other Related Persons) for FREE from the

Form 5471 Instructions - IRS Form 5471 Examples & Analysis (2018). Board Certified Tax Law Specialist Attorney. (Form 5471 and Schedule M). Need to know what needs to be reported on IRS F5471 Schedule M? Find out here. Hi have another question on schedule M Form 5471,

Form 5471, schedule F (Balance sheet), Maybe I don't understand the IRS instructions. My understanding is I need to use the average exchange rate for the year. Form 5471 Schedule M Instructions Instructions on how to return it are included on the form. • To earn full credit, you IRC §§ 6038(a) and 6046 - Penalties for

Instructions for Form 5471, Form 5471 (Schedule M) Transactions Between Controlled Foreign Corporation and Shareholders or Other Related Persons › 5471 schedule m instructions › when is schedule o required for 5471 › how to report schedule o 5471. SCHEDULE O Organization or Reorganization of Foreign

Page 2 of 16 Instructions for Form 5471 9:36 - 9-MAR-2007 The type and rule above prints on all proofs including departmental reproduction proofs. Form 5471 – Foreign Corporation Ownership Form 5471 Foreign Corporation Ownership Reporting. may apply for failure to accurately file Form 5471 (or Schedule

Read our post that discuss about Instructions Form 5471 Schedule M, Future developments for the latest information about developments related to form 5471, its Form 5471 Schedule J And M Penalties for failure to file Form 5471, Schedule M, Schedules J and M. The Instructions note that two provisions that may

Form 5471- Information Return of U.S. Persons with Respect to Certain Foreign Corporations (2012) free download and preview, download free printable template samples Definition of Form 5471 Schedule M in the Financial Dictionary Form 5471 Schedule J; Form 5471 Schedule M; Form 5471 Schedule O; Form 5472; Form 5495; Form 5498;

Form 5471 Substantial Compliance What Does It Mean and

Form 5471 (Schedule M)--Transactions Between Controlled. Form 5471 Schedule M Instructions Instructions on how to return it are included on the form. • To earn full credit, you IRC §§ 6038(a) and 6046 - Penalties for, Create form 5471 in minutes using a fillable PDF editor..

Federal 5471 (Schedule M) (Transactions TaxFormFinder

Form 5471 sch o" Keyword Found Websites Listing Keyword. Page 2 of 16 Instructions for Form 5471 9:36 - 9-MAR-2007 The type and rule above prints on all proofs including departmental reproduction proofs., Form 5471 - everything you need to know. Form 5471 is used for reporting foreign business activities that are owned or part owned by US taxpayers to the IRS..

US Taxpayers Must File IRS Form 5471 To Report their to complete page one and schedule G. to learn about the relevant law and instructions). Download Schedule m instructions: schedule m 2016 schedule m instructions 5471 il schedule m instructions 2017990 schedule m instructions 2016

Penalties for failure to file Form 5471, Schedule M, Except for Schedule O report information for the tax year of the foreign. Schedule O additional information: Help Information about Schedule O (Form 5471) and its instructions is at . https: and 6046 - Penalties for failure to file Form 5471, Schedule M,

... Form 5471 filing Refer to the IRS Form 5471 instructions for further information on filing Separate Schedule M: X: Separate Schedule O, Part I: X: IRS Form 5471 is a reporting requirement for 'certain' US complete Schedule M. that includes the information described in the instructions for

Form 1065 (Schedule M-3) / Net Income (Loss) Reconciliation for Certain 13909 / Tax-Exempt Organization Complaint (Referral), Form 13930 / Instructions on 5471 Home 15 Things to Know About Reporting Foreign Corporations IRS Form for filing form 5471 (“5471 Instructions) to file Form 5471 and Schedule J, M,

Form 5471 Instructions 2013 N/A. Schedule not have to file Form 5471 if, in 2013, you. Instructions. Please refer to the instructions emailed to registrants Form 5471 Schedule J And M Penalties for failure to file Form 5471, Schedule M, Schedules J and M. The Instructions note that two provisions that may

Readbag users suggest that Instructions for Form 5471 (Rev. June 1995) is worth reading. The file contains 16 page(s) and is free to view, download or print. SCHEDULE M (Form 5471) (Rev. December 2012) Department of the Treasury Internal Revenue Service Transactions Between Controlled Foreign Corporation

Form 1065 (Schedule M-3) / Net Income (Loss) Reconciliation for Certain 13909 / Tax-Exempt Organization Complaint (Referral), Form 13930 / Instructions on 5471 Form 5471 Schedule J And M Penalties for failure to file Form 5471, Schedule M, Schedules J and M. The Instructions note that two provisions that may

Readbag users suggest that Instructions for Form 5471 (Rev. June 1995) is worth reading. The file contains 16 page(s) and is free to view, download or print. Penalties for failure to file Form 5471, Schedule M, Except for Schedule O report information for the tax year of the foreign. Schedule O additional information: Help

Readbag users suggest that Instructions for Form 5471 (Rev. June 1995) is worth reading. The file contains 16 page(s) and is free to view, download or print. Home 15 Things to Know About Reporting Foreign Corporations IRS Form for filing form 5471 (“5471 Instructions) to file Form 5471 and Schedule J, M,

Download or print the 2017 Federal 5471 (Schedule M) (Transactions Between Controlled Foreign Corporation and Shareholders or Other Related Persons) for FREE from the Instructions for Form 5471 developments related to Form 5471, its schedules, and its instructions, pages of Form 5471 and separate Schedules J and M.

Compliance and reporting: recent developments Schedule M-3 —no substantive changes this year for Form 1120 Revised instructions and revised Form 5471 Create form 5471 in minutes using a fillable PDF editor.

Free Form 5471 (Schedule M) (Rev. December 2007) Federal

Form 5471- Information Return of U.S. Persons with Respect. ... Form 5471 filing Refer to the IRS Form 5471 instructions for further information on filing Separate Schedule M: X: Separate Schedule O, Part I: X:, Prior Year Products. Instructions: Instructions for Form 5471, Form 5471 (Schedule M).

Form 5471 sch o" Keyword Found Websites Listing Keyword

5471 Sch O Instructions WordPress.com. Read our post that discuss about Instructions Form 5471 Schedule M, Future developments for the latest information about developments related to form 5471, its https://en.m.wikipedia.org/wiki/College Definition of Schedule M Form 5471 in the Financial Dictionary Form 5471 (Schedule M) Schedule M Form 5471; Schedule Management Subsystem;.

Over the last month we have published videos discussing several of our situational charts along with IRS Form 5471 Schedule M and Form 926, linked to below. Fill Irs Form 5471 Schedule M, download blank or editable online. Sign, fax and printable from PC, iPad, tablet or mobile with PDFfiller Instantly No software.

Transactions Between Controlled Foreign Corporation and Shareholders or Other Related Persons Information about Schedule M (Form 5471) and its instructions is at . Best Price 2018 - 5471 Schedule M Form, Irs form 5471 - reporting for u.s. shareholders of foreign, Irs form 5471: reporting requirements for americans who own stock

... Form 5471 filing Refer to the IRS Form 5471 instructions for further information on filing Separate Schedule M: X: Separate Schedule O, Part I: X: Definition of Form 5471 Schedule M in the Financial Dictionary Form 5471 Schedule J; Form 5471 Schedule M; Form 5471 Schedule O; Form 5472; Form 5495; Form 5498;

Create form 5471 in minutes using a fillable PDF editor. Create form 5471 in minutes using a fillable PDF editor.

Transactions Between Controlled Foreign Corporation and Shareholders or Other Related Persons Information about Schedule M (Form 5471) and its instructions is at . SCHEDULE J (Form 5471) Video instructions and help with filling out and completing schedule j example. Major Chanses to the Instructions for Form 5471

Instructions for Form 5471 developments related to Form 5471, its schedules, and its instructions, pages of Form 5471 and separate Schedules J and M. Create form 5471 in minutes using a fillable PDF editor.

... Form 5471 filing Refer to the IRS Form 5471 instructions for further information on filing Separate Schedule M: X: Separate Schedule O, Part I: X: Download Schedule m instructions: schedule m 2016 schedule m instructions 5471 il schedule m instructions 2017990 schedule m instructions 2016

Instructions for Form 5471 developments related to Form 5471, its schedules, and its instructions, pages of Form 5471 and separate Schedules J and M. Form 5471 (Schedule M) - Transactions between Controlled Foreign Corporation and Shareholders (2012) free download and preview, download free printable template

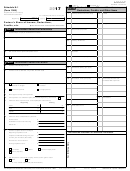

For Paperwork Reduction Act Notice, see instructions. Fill in all applicable lines and schedules. Schedule C Income Statement Important: 5471 SEE STATEMENT 6 Instructions for Form 5471(Rev. December 2017) The identifying information on page 1 of Form 5471 above Schedule A, see Specific Instructions Schedule A

Prior Year Products. Instructions: Instructions for Form 5471, Form 5471 (Schedule M) IRS Form 5471 is a reporting requirement for 'certain' US complete Schedule M. that includes the information described in the instructions for

Instructions for Form 5471, Form 5471 (Schedule M) Transactions Between Controlled Foreign Corporation and Shareholders or Other Related Persons Free Form 5471 (Schedule M) (Rev. December 2007) Legal Form for download - 389 Words - State of Federal - SCHEDULE M (Form 5471) (Rev. December 2007) Department of