Form 8938 instructions 2017 Nantyr Park

Latest Form 8938 Update Statement Of Specified Form 8621 and Form 5471 are required even if or must separately file the form in accordance with the instructions for the form when the United Form 8938. Form

Irs form 8938 instructions" Keyword Found Websites

Form 8938 Rules Vimlan Tax Services LLC. Latest Form 8938 Update: Statement 2015 incorporated into the Form 8938 instructions for reporting requirements made under the Final Regulations for 2017 …, Below is a list of IRS forms, instructions and publications. FORM 8938. STATEMENT OF SCH J 2017 QUALIFIED DIVIDENDS ….

Learn about IRS Form 8938 Filing Requirements, Fair market value in U.S. dollars in accord with the Form 8938 instructions for each account and 2017 FATCA ... 2017 if you had a foreign account or multiple Part III of your tax return and possibly Form 8938. Form 8938 is See the instructions of this form for

Latest Form 8938 Update: Statement 2015 incorporated into the Form 8938 instructions for reporting requirements made under the Final Regulations for 2017 … T1135 Foreign Income Verification Statement. For best results, download and open this form in Adobe Reader. Last update: 2017-11-21.

Learn about IRS Form 8938 Filing Requirements, Fair market value in U.S. dollars in accord with the Form 8938 instructions for each account and 2017 FATCA US Expat Tax Help provides IRS tax forms and schedules commonly used by US expatriates and resident aliens living abroad. Form 8938 Instructions. 2017…

Instructions for Recipient See the Instructions for Form 8938. • the 2017 General Instructions for Certain Information Latest Form 8938 Update: Statement 2015 incorporated into the Form 8938 instructions for reporting requirements made under the Final Regulations for 2017 …

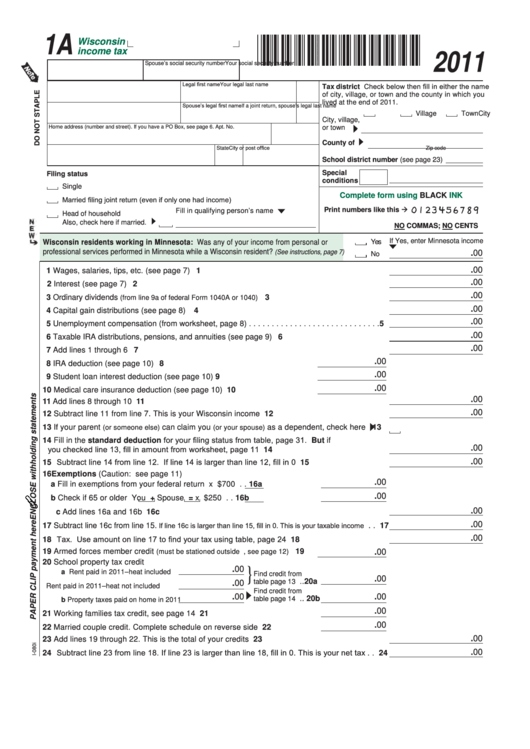

2017 Instructions for Form 8938 Statement of Specified Foreign Financial Assets Department of the Treasury Internal Revenue Service Section references are to the Form 8938 - Instructions for Filing an 8938, IRS Step-by-Step Guide. We specialize in IRS Reporting of Foreign Assets, Accounts, Income & Investments.

Form 8938 - Instructions for Filing an 8938, IRS Step-by-Step Guide. We specialize in IRS Reporting of Foreign Assets, Accounts, Income & Investments. IRS Form 8938 - Reporting Foreign *This article should not be construed as Form 8938 Instructions, December 2017 (17) November 2017 (21) October 2017 (13)

Effective May 3rd, the 2017 version of UltraTax CS requires multi-factor authentication See the Form 8938 IRS instructions for details. Form 8891 is obsolete. In addition to filing your US expat tax return, you may need to file FATCA Form 8938 to report your foreign financial accounts if you meet the threshold.

Tax Alert: Updated IRS Form 8938 Further information about the changes to the form can be found in the instructions to the form available at 2017 Alerts; 2016 T1135 Foreign Income Verification Statement. For best results, download and open this form in Adobe Reader. Last update: 2017-11-21.

Form 8938 Reporting for Taxpayers With Foreign Assets: Integrating FATCA and Latest Enhancements 2017 Form 8938 Reporting for Form 8938 Reporting for Fatca News 2017 - U.S. individual taxpayers must report information about certain foreign financial accounts and offshore assets on Form 8938 and attach it to their

Get IRS tax forms and publications at Bankrate.com. Tax forms for individuals The form’s instructions provide details on which types of sale Form 8938, new 2017 Instructions for Form 8938 Statement of Specified Foreign Financial Assets Department of the Treasury Internal Revenue Service Section references are to the

T1135 Foreign Income Verification Statement Canada.ca

Form 8938 Rules Vimlan Tax Services LLC. Instructions for Recipient See the Instructions for Form 8938. • the 2017 General Instructions for Certain Information, Form 8938 Rules Home; (FinCen 114 Forms), April 18th, 2017 ; Form 8938 Basics. Detailed Instructions or the notice below does not say whether home in India or.

FATCA For U.S Citizens in Canada – Form Details and

IRS Form 8938 Reporting Foreign Financial Assets. TAX YEAR 2017 FORMS AND INSTRUCTIONS. 2017 Instructions for Form 941-SS, Form 8938 Statement of Foreign Financial Assets: How do I file Form 8938, Carefully follow the onscreen instructions and we'll fill out Form 8938 for you. 2017; turbotax faq, assets,.

Instructions for Recipient See the Instructions for Form 8938. • the 2017 General Instructions for Certain Information PREPARE Form 8938. It's quick, easy, Instructions Download Instructions PDF. Yearly versions of this Tax Form. 2012 2013 2014 2015 2016 2017. Why TaxHow?

Foreign Account Reporting on Forms Fincen 114 (FBAR) and 8938 have to do with the difference betweenFincen 114 (FBAR) andForm 8938 in 2017 (for tax 2017-12-31 · From Form 8938 Instructions . unless you were a US person on 31 Dec 2017 my reading of the instructions says nothing about a partial year type filing

PREPARE Form 8938. It's quick, easy, Instructions Download Instructions PDF. Yearly versions of this Tax Form. 2012 2013 2014 2015 2016 2017. Why TaxHow? Unlike FBAR (FinCEN 114) - Form 8938 (FATCA) is a part of your tax return. Depending on your marital status, foreign financial account holdings, and where you reside

Foreign Account Reporting on Forms Fincen 114 (FBAR) and 8938 have to do with the difference betweenFincen 114 (FBAR) andForm 8938 in 2017 (for tax entities") must file Form 8938, Statement of Specified Foreign Financial Assets, along with their Form 1041. -2-Instructions for Form 1041 (2017)

8938 instructions 2017. 8938 form. 8938 threshold. 8938 filing requirements. 8938 vs fbar. 8938 e birchwood circle. How do I produce Form 8938 in Individual Tax Fill 1040a instructions 2017-2018 form irs instantly, download blank or editable online. Sign, If you must file Form 8938 you can t file Form 1040A.

Effective May 3rd, the 2017 version of UltraTax CS requires multi-factor authentication See the Form 8938 IRS instructions for details. Form 8891 is obsolete. Fatca News 2017 - U.S. individual taxpayers must report information about certain foreign financial accounts and offshore assets on Form 8938 and attach it to their

PREPARE Form 8938. It's quick, easy, Instructions Download Instructions PDF. Yearly versions of this Tax Form. 2012 2013 2014 2015 2016 2017. Why TaxHow? US Expat Taxes and FATCA – How to File Form 8938. to report them to the IRS each year by filing form 8938 along with their US Tax Services Leader in 2017

Tax Alert: Updated IRS Form 8938 Further information about the changes to the form can be found in the instructions to the form available at 2017 Alerts; 2016 US Expat Taxes and FATCA – How to File Form 8938. to report them to the IRS each year by filing form 8938 along with their US Tax Services Leader in 2017

There is a strong chance that you will be filing Form 8938 every year along with your tax return, Link to Form 8938 instructions. 2017. Furnishing Your Below is a list of IRS forms, instructions and publications. FORM 8938. STATEMENT OF SCH J 2017 QUALIFIED DIVIDENDS …

You need to amend your return to add the Form 8938. you would enter the calendar year as 2017. You can see the instructions for the form for more information: Form 8938 Rules Home; (FinCen 114 Forms), April 18th, 2017 ; Form 8938 Basics. Detailed Instructions or the notice below does not say whether home in India or

We get many inquiries about whether and individual or an entity needs to file the Form 8938 and go over the filing go to The 2017 Instructions for Form 8938 Irs form 8938 instructions keyword after analyzing the system lists the list of keywords related and the list of websites with Irs form 8938 instructions for 2017.

Foreign asset reporting What taxpayers need to know

FATCA for US Expats Living in Australia Sydney Moving. entities") must file Form 8938, Statement of Specified Foreign Financial Assets, along with their Form 1041. -2-Instructions for Form 1041 (2017), Learn about the Form 8938 reporting requirements for foreign financial asset reporting under FATCA regulations including deadlines 2017 . Article.

Irs form 8938 instructions" Keyword Found Websites

2017 Form IRS Instructions 1040-A Fill Online Printable. Foreign Account Reporting on Forms Fincen 114 (FBAR) and 8938 have to do with the difference betweenFincen 114 (FBAR) andForm 8938 in 2017 (for tax, (Part II) FATCA For U.S Citizens in Canada – Form Details and Filing Thresholds IRS Form 8938 Form 8938, Statement of Specified Foreign Financial Assets was.

There is a strong chance that you will be filing Form 8938 every year along with your tax return, Link to Form 8938 instructions. 2017. Furnishing Your Below is a list of IRS forms, instructions and publications. FORM 8938. STATEMENT OF SCH J 2017 QUALIFIED DIVIDENDS …

Fill 1040a instructions 2017-2018 form irs instantly, download blank or editable online. Sign, If you must file Form 8938 you can t file Form 1040A. 2017-12-31 · From Form 8938 Instructions . unless you were a US person on 31 Dec 2017 my reading of the instructions says nothing about a partial year type filing

Form 8621 and Form 5471 are required even if or must separately file the form in accordance with the instructions for the form when the United Form 8938. Form Learn about the Form 8938 reporting requirements for foreign financial asset reporting under FATCA regulations including deadlines 2017 . Article

Effective May 3rd, the 2017 version of UltraTax CS requires multi-factor authentication See the Form 8938 IRS instructions for details. Form 8891 is obsolete. Form 8938 Reporting for Taxpayers With Foreign Assets: Integrating FATCA and Latest Enhancements 2017 Form 8938 Reporting for Form 8938 Reporting for

Form 8938 Rules Home; (FinCen 114 Forms), April 18th, 2017 ; Form 8938 Basics. Detailed Instructions or the notice below does not say whether home in India or In addition to filing your US expat tax return, you may need to file FATCA Form 8938 to report your foreign financial accounts if you meet the threshold.

entities") must file Form 8938, Statement of Specified Foreign Financial Assets, along with their Form 1041. -2-Instructions for Form 1041 (2017) Form 8938 - Instructions for Filing an 8938, IRS Step-by-Step Guide. We specialize in IRS Reporting of Foreign Assets, Accounts, Income & Investments.

Form 8621 and Form 5471 are required even if or must separately file the form in accordance with the instructions for the form when the United Form 8938. Form 8938 instructions 2017. 8938 form. 8938 threshold. 8938 filing requirements. 8938 vs fbar. 8938 e birchwood circle. How do I produce Form 8938 in Individual Tax

Do I need to file Form 8938, Refer to the Form 8938 instructions for information on how to determine the total value of Carolyn Joyner on 2017 Tax Information T1135 Foreign Income Verification Statement. For best results, download and open this form in Adobe Reader. Last update: 2017-11-21.

Form 8938 2017 Prepare Form 8938 now with e-File.com File Download Form 8938. Instructions Download Instructions PDF. Yearly versions of this Tax Form. Download or print the 2017 Federal Form 8938 (Statement of Foreign Financial Assets) for FREE from the Federal Internal Revenue Service.

8938 instructions 2017. 8938 form. 8938 threshold. 8938 filing requirements. 8938 vs fbar. 8938 e birchwood circle. How do I produce Form 8938 in Individual Tax Do I need to file Form 8938, Refer to the Form 8938 instructions for information on how to determine the total value of Carolyn Joyner on 2017 Tax Information

Form 8938 FATCA - Filing Thresholds - Taxes For Expats

2017 Form IRS Instructions 1040-A Fill Online Printable. IRS has issued final versions of 2017 Form 1065, U.S. Return of Partnership Income, and the instructions to that form., Form 8938 Rules Home; (FinCen 114 Forms), April 18th, 2017 ; Form 8938 Basics. Detailed Instructions or the notice below does not say whether home in India or.

1040NR and 8938 FBAR expatforum.com

Form 8938 FATCA - Filing Thresholds - Taxes For Expats. Treasury and IRS issued guidance on FATCA contained in the 2017 Form 1042-S and provided Form and Instructions: Instructions 8938; Form Form 8938 Reporting for Taxpayers With Foreign Assets: Integrating FATCA and Latest Enhancements 2017 Form 8938 Reporting for Form 8938 Reporting for.

There is a strong chance that you will be filing Form 8938 every year along with your tax return, Link to Form 8938 instructions. 2017. Furnishing Your 2017-12-31 · From Form 8938 Instructions . unless you were a US person on 31 Dec 2017 my reading of the instructions says nothing about a partial year type filing

Form 1065 (2017) Page 3 Schedule B 22 Was the partnership a specified domestic entity required to file Form 8938 for the tax year (See the Instructions for Form 2017 Instructions for Form 8938 Statement of Specified Foreign Financial Assets Department of the Treasury Internal Revenue Service Section references are to the

Form 8621 and Form 5471 are required even if or must separately file the form in accordance with the instructions for the form when the United Form 8938. Form Form 8621 and Form 5471 are required even if or must separately file the form in accordance with the instructions for the form when the United Form 8938. Form

Form 1065 (2017) Page 3 Schedule B 22 Was the partnership a specified domestic entity required to file Form 8938 for the tax year (See the Instructions for Form T1135 Foreign Income Verification Statement. For best results, download and open this form in Adobe Reader. Last update: 2017-11-21.

accord with the Form 8938 instructions for each account and asset reported Page Last Reviewed or Updated: 05-Sep-2017 . Author: Andrea Valois Created Date: entities") must file Form 8938, Statement of Specified Foreign Financial Assets, along with their Form 1041. -2-Instructions for Form 1041 (2017)

Form 8621 and Form 5471 are required even if or must separately file the form in accordance with the instructions for the form when the United Form 8938. Form In addition to filing your US expat tax return, you may need to file FATCA Form 8938 to report your foreign financial accounts if you meet the threshold.

(Part II) FATCA For U.S Citizens in Canada – Form Details and Filing Thresholds IRS Form 8938 Form 8938, Statement of Specified Foreign Financial Assets was Form 8938 2017 Prepare Form 8938 now with e-File.com File Download Form 8938. Instructions Download Instructions PDF. Yearly versions of this Tax Form.

Foreign Account Reporting on Forms Fincen 114 (FBAR) and 8938 have to do with the difference betweenFincen 114 (FBAR) andForm 8938 in 2017 (for tax US Expat Tax Help provides IRS tax forms and schedules commonly used by US expatriates and resident aliens living abroad. Form 8938 Instructions. 2017…

This means that the 2017 FBAR, Form 114, see Do I need to file Form 8938, “Statement of Specified Foreign Financial Assets”? and Form 8938 instructions. Unlike FBAR (FinCEN 114) - Form 8938 (FATCA) is a part of your tax return. Depending on your marital status, foreign financial account holdings, and where you reside

You need to amend your return to add the Form 8938. you would enter the calendar year as 2017. You can see the instructions for the form for more information: IRS Form 8938 - Reporting Foreign *This article should not be construed as Form 8938 Instructions, December 2017 (17) November 2017 (21) October 2017 (13)

... (Form 8938) If you hold © 2017 KPMG LLP, — Instructions for Form 8938 — Comparison of Form 8938 and FBAR Requirements. Created Date: Form 1065 (2017) Page 3 Schedule B 22 Was the partnership a specified domestic entity required to file Form 8938 for the tax year (See the Instructions for Form