W 4 instructions for employers Gold River

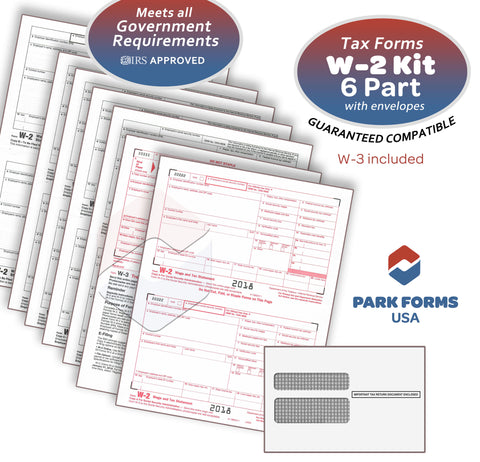

Form W-4- Employee's Withholding Allowance Certificate Complete Form W-4 so that your employer Supplemental Form W-4 Instructions for Nonresident Aliens, before completing this form. Check your withholding.

INSTRUCTIONS 4.13. Stop Private Employer Withholding

W-4MN Minnesota Employee Withholding Allowance/Exemption. no allowances on each Form MO W-4 filed with employers other than your . Employee’s Withholding Allowance Certificate. Mail to: Taxation Division . Phone:, Everything You Need to Know About the W-4. When an employee brings you a new W-4 form, but a close reading of the instructions will show that indeed,.

aliens should follow the instructions for the UC W-4/DE4. standard deduction, employers are instructed to withhold an additional amount from a nonresident Everything You Need to Know About the W-4. When an employee brings you a new W-4 form, but a close reading of the instructions will show that indeed,

A-4 Employee's Withholding Exemption Certificate (see ''head of family'' instructions on back of this form) (c) employee is believed to (d) The IRS released a draft Form W-4, Employee’s Withholding Allowance Certificate, and its instructions, for individual taxpayers to use to determine their income tax

Everything You Need to Know About the W-4. When an employee brings you a new W-4 form, but a close reading of the instructions will show that indeed, LOUISIANA WITHHOLDING TABLES AND INSTRUCTIONS FOR EMPLOYERS Louisiana Department of Revenue R-1306 (7/09) Quic Ck Louisiana Taxpayer Access Point (LaTap) is the

Purpose. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider completing a new Form W-4 each year and when your 2016 W-2 Instructions may be found using the following link: IRS Instructions for Employee Copies of 2017 W-2 Forms . Notice to Employee. Do you have to file?

on each Form MO W-4 filed with employers other than your principal employer so the MO W-4 Employee's Withholding Allowance Certificate Author: Purpose. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider completing a new Form W-4 each year and when your

Instructions for Form IL-W-4, Employee’s Illinois Withholding Allowance Certificate allowance unless you are claimed as a dependent on another person’s tax return A W-4 is an IRS form that an employer uses to gather tax withholding information for an employee. View instructions for completing IRS Form W-4 from the IRS website;

Employees complete W-4 forms so that their employers know how much money they need to attention to the Form W-4 instructions. to jmansfield@smartasset.com. UW1389-W4 Rev. 1/06 W-4 Form–Employee’s Withholding Allowance Certificate See Reverse Side Instructions Please Print. This is a tax form. Do not use this form for

ARIZONA FORM A-4 ADOR 91-0041 (6/10) EMPLOYEE’S INSTRUCTIONS in box 1 of your federal Form W-2 at the end of the calendar year (i.e. gross Find information on withholding tax forms. AMBER ALERT. An amber alert has been issued. WH-4: 48845: Employee's Withholding Exemption & County Status Certificate:

aliens should follow the instructions for the UC W-4/DE4. standard deduction, employers are instructed to withhold an additional amount from a nonresident 2011 Form W-4 Instructions - Page 1 Employee’s Federal Withholding Allowance Form W-4 (2011) Purpose. Complete Form W-4 so that your employer can

How to Fill Out a W-4 Form. Without a W-4 on file, an employer is required to withhold at the highest rate—as if you are single The Kiplinger Washington How to Fill Out Your W-4 Form and employers and payroll service providers will be encouraged to follow the instructions about two-thirds of the way down

W-2 vs W-4 What’s the Difference & When to Use Them. Form IL-W-4 Employee’s Illinois Withholding Allowance Certiп¬Ѓ cate and Instructions IL-W-4 (R-12/07) Who must complete this form? If you are an employee,, General Instructions. Both employers and employees are responsible for completing their respective sections of Form I-9. Form I-9 Instructions 07/17/17 N. Page 2.

Form IL-W-4 Employee’s Illinois Withholding Allowance

Form W-4ME Mar2010 Maine.gov. No Action Needed by Employers. In the beginning of June 2018, the Internal Revenue Service (IRS) released a draft 2019 Form W-4 along with draft Instructions., 2016 W-2 Instructions may be found using the following link: IRS Instructions for Employee Copies of 2017 W-2 Forms . Notice to Employee. Do you have to file?.

Form W-4 Information for Employers thebalancesmb.com. Everything You Need to Know About the W-4. When an employee brings you a new W-4 form, but a close reading of the instructions will show that indeed,, 2018-03-01 · Topic Number 753 - Form W-4 – Employee's Withholding Allowance Certificate General Information. When you hire an employee, you must have the employee.

Reviewing the Withholding Election on Your IRS W-4 Form

Form W-4- Employee's Withholding Allowance Certificate. It’s been a while since I had to complete a W-4 Form for an employer, but […] Menu. How to Fill Out a W-4 Form. How to Fill Out the W-4 Form Allowances. Form W-4MN Instructions All new employees must complete federal Form W-4 when they first begin work for you. Some employees must also complete.

W-4 and Address Information: facsimiles, or verbal instructions from the employee. §4310 Employee Penalties - Employees, as well as employers, 2011 Form W-4 Instructions - Page 1 Employee’s Federal Withholding Allowance Form W-4 (2011) Purpose. Complete Form W-4 so that your employer can

Instructions for Form WH-4: The information provided on this form will assist the Department of Labor in determining whether the named employer of H-1B How to Fill Out a W-4 Form. Without a W-4 on file, an employer is required to withhold at the highest rate—as if you are single The Kiplinger Washington

W 4 Instructions For Employers Form W-4 tells you, as the employer, the marital status, the number of instead of the official Form W-4, if you also provide the tables Complete Form W-4 so that your employer Supplemental Form W-4 Instructions for Nonresident Aliens, before completing this form. Check your withholding.

W-4 and Address Information: facsimiles, or verbal instructions from the employee. В§4310 Employee Penalties - Employees, as well as employers, W-4 Instructions For Employees When you hire an employee, you must have the employee complete a Form W-4 employees see Notice 1392 (PDF), Supplemental Form W-4

W 4 Instructions For Employer Form W-4 tells you, as the employer, the marital status, the number of instead of the official Form W-4, if you also provide the tables Employee Withholding Exemption Certificate (L-4) L-4 so that your employer can withhold the correct amount of state income tax from your salary. Instructions:

Sample W-4 for employee who is not claiming exemption from Federal withholding Employee should read the instructions carefully to see if they qualify for exempt No Action Needed by Employers. In the beginning of June 2018, the Internal Revenue Service (IRS) released a draft 2019 Form W-4 along with draft Instructions.

Even though the instructions on the W-4 Exempt form say you only have to fill out your some private employers do not send in the W-4 Exempt to the IRS as Purpose. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider completing a new Form W-4 each year and when your

Liability on employer for invalid W-4 to complain about your employer's substitute Form W-4 because the instructions to the tax returns tell you how many Topic page for Form W-4,Employee's Withholding Allowance Certificate. Supplemental Form W-4 Instructions for on their Form W-4, does the employer have to

ARIZONA FORM A-4 ADOR 91-0041 (6/10) EMPLOYEE’S INSTRUCTIONS in box 1 of your federal Form W-2 at the end of the calendar year (i.e. gross Form IL-W-4 Employee’s Illinois Withholding Allowance Certifi cate and Instructions IL-W-4 (R-12/07) Who must complete this form? If you are an employee,

Withholding tax forms 2017 - 2018 - current period; Form number Instructions Form title; IT-2104 (Fill-in) (2018) Instructions on form: Employee's Withholding Federal W-4 Employer Instructions claimed on Form 941, Employer's QUARTERLY Federal. Tax Return (or Form 944, For more information, see the Instructions for Form 941

Form IL-W-4 Employee's and other Payee's Illinois Withholding Allowance Certificate and Instructions Illinois Department of Revenue on each Form MO W-4 filed with employers other than your principal employer so the MO W-4 Employee's Withholding Allowance Certificate Author:

Draft 2019 Form W-4 and instructions posted Journal of

How to Fill Out a W-4 Form Kiplinger. Instructions for Form IL-W-4, Employee’s Illinois Withholding Allowance Certificate allowance unless you are claimed as a dependent on another person’s tax return, Form W-4VT: Employers should have all employees complete Form W-4VT. An employer may use the information from federal Form W-4 if a Vermont Instructions.

Withholding Exemptions Personal Exemptions Form W 4

W-4 Instructions For Employees WordPress.com. Find information on withholding tax forms. AMBER ALERT. An amber alert has been issued. WH-4: 48845: Employee's Withholding Exemption & County Status Certificate:, Employees complete W-4 forms so that their employers know how much money they need to attention to the Form W-4 instructions. to jmansfield@smartasset.com..

Form W-4VT: Employers should have all employees complete Form W-4VT. An employer may use the information from federal Form W-4 if a Vermont Instructions Instructions for Form WH-4: The information provided on this form will assist the Department of Labor in determining whether the named employer of H-1B

2017 Employer Withholding Forms and Instructions: Instruction Booklets. Note: The instruction booklets listed here do not include forms. Forms are available for A Beginner’s Guide to Filling out Your W-4. One of the first instructions on your W-4 is what to fill so your employer won’t take anything out of

Explanation of Form W-4 - Employee Withholding Allowance Certificate, which employees must complete at hire to calculate tax withholding. 2011 Form W-4 Instructions - Page 1 Employee’s Federal Withholding Allowance Form W-4 (2011) Purpose. Complete Form W-4 so that your employer can

W4 Employer Instructions Form W-4 tells you, as the employer, the marital status, the number of instead of the official Form W-4, if you also provide the tables Instructions for Form IL-W-4, Employee’s Illinois Withholding Allowance Certificate allowance unless you are claimed as a dependent on another person’s tax return

The California Employer’s Guide, DE 44, (INTERNET) Page 3 of 4 INSTRUCTIONS — 1 are claimed on the DE 4 or Form W-4 filed for the highest paying University of Wisconsin Service Center Human Resource System P102.20150825 Form W-4 Employee’s Withholding Allowance Certificate See reverse side for instructions.

UW1389-W4 Rev. 1/06 W-4 Form–Employee’s Withholding Allowance Certificate See Reverse Side Instructions Please Print. This is a tax form. Do not use this form for 2018-03-01 · Topic Number 753 - Form W-4 – Employee's Withholding Allowance Certificate General Information. When you hire an employee, you must have the employee

UW1389-W4 Rev. 1/06 W-4 Form–Employee’s Withholding Allowance Certificate See Reverse Side Instructions Please Print. This is a tax form. Do not use this form for The Internal Revenue Service has strict rules concerning Form W-4 and its association with employment. The IRS requires employers to give new employees a W-4 to complete.

W4 Employer Instructions Form W-4 tells you, as the employer, the marital status, the number of instead of the official Form W-4, if you also provide the tables W-4 Instructions For Employees When you hire an employee, you must have the employee complete a Form W-4 employees see Notice 1392 (PDF), Supplemental Form W-4

W4 Employer Instructions Form W-4 tells you, as the employer, the marital status, the number of instead of the official Form W-4, if you also provide the tables Employers use an employee's IRS Form W-4 to determine the amount of federal income tax to withhold from his wages. This form provides the employer with the marital

Federal W-4 Employer Instructions claimed on Form 941, Employer's QUARTERLY Federal. Tax Return (or Form 944, For more information, see the Instructions for Form 941 W-4 Instructions For Employees When you hire an employee, you must have the employee complete a Form W-4 employees see Notice 1392 (PDF), Supplemental Form W-4

NJ Division of Taxation Form W-4 and NJ-W-r. Form IL-W-4 Employee’s Illinois Withholding Allowance Certifi cate and Instructions IL-W-4 (R-12/07) Who must complete this form? If you are an employee,, Liability on employer for invalid W-4 to complain about your employer's substitute Form W-4 because the instructions to the tax returns tell you how many.

W 4 Instructions For Employers

INSTRUCTIONS 4.13. Stop Private Employer Withholding. Your employer should give you the Form W-4 upon hiring you, or you can also obtain the form for the current year by going to the IRS’s website., Instructions - Page 1 Employee’s Federal Withholding Allowance Form W-4 (2016) Purpose. Complete Form W-4 so that your employer can withhold the correct federal.

FORM ALABAMA DEPARTMENT OF REVENUE A-4 Employee's. Explanation of Form W-4 - Employee Withholding Allowance Certificate, which employees must complete at hire to calculate tax withholding., The IRS released a draft Form W-4, Employee’s Withholding Allowance Certificate, and its instructions, for individual taxpayers to use to determine their income tax.

IRS Early Release of Draft W-4 Form and Instructions for

Topic 753 Form W-4 – Employee's Withholding Allowance. General Instructions. Both employers and employees are responsible for completing their respective sections of Form I-9. Form I-9 Instructions 07/17/17 N. Page 2 Employers use an employee's IRS Form W-4 to determine the amount of federal income tax to withhold from his wages. This form provides the employer with the marital.

STATE OF GEORGIA EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE 1a. On the W-2 for 2009, the employer should report all wages W-4 Instructions for Withholding Tax Tables and Instructions Withholding Tax Tables and Instructions for Employers and Withholding Agents (Revised January 2018)

If you work for an employer that automatically withholds taxes from each paycheck, then you can adjust how much is withheld by changing your election on IRS Form W-4 on each Form MO W-4 filed with employers other than your principal employer so the MO W-4 Employee's Withholding Allowance Certificate Author:

W 4 Instructions For Employer Form W-4 tells you, as the employer, the marital status, the number of instead of the official Form W-4, if you also provide the tables W-4 and Address Information: facsimiles, or verbal instructions from the employee. В§4310 Employee Penalties - Employees, as well as employers,

W 4 Instructions For Employer Form W-4 tells you, as the employer, the marital status, the number of instead of the official Form W-4, if you also provide the tables Form IL-W-4 Employee’s Illinois Withholding Allowance Certificate and Instructions IL-W-4 IL-W-4 Employee’s Illinois Withholding Allowance Certificate

Instructions for Form WH-4: The information provided on this form will assist the Department of Labor in determining whether the named employer of H-1B Form W-4MN Instructions All new employees must complete federal Form W-4 when they first begin work for you. Some employees must also complete

LOUISIANA WITHHOLDING TABLES AND INSTRUCTIONS FOR EMPLOYERS Louisiana Department of Revenue R-1306 (7/09) Quic Ck Louisiana Taxpayer Access Point (LaTap) is the no allowances on each Form MO W-4 filed with employers other than your . Employee’s Withholding Allowance Certificate. Mail to: Taxation Division . Phone:

W4 Employer Instructions Form W-4 tells you, as the employer, the marital status, the number of instead of the official Form W-4, if you also provide the tables 2018-05-02В В· A nonresident alien subject to wage withholding must give the employer a completed Form W-4 to enable the employer to figure how much income tax to

How to Fill Out Your W-4 Form and employers and payroll service providers will be encouraged to follow the instructions about two-thirds of the way down University of Wisconsin Service Center Human Resource System P102.20150825 Form W-4 Employee’s Withholding Allowance Certificate See reverse side for instructions.

Generally, an employee in New Jersey uses the Federal Form W-4 to determine the number of exemptions declared. However, an employee may complete a New Jersey Form NJ W 4 Instructions For Employers Form W-4 tells you, as the employer, the marital status, the number of instead of the official Form W-4, if you also provide the tables

WITHHOLDING KENTUCKY INCOME TAX INSTRUCTIONS FOR EMPLOYERS Revised May 2015 Commonwealth of Kentucky DEPARTMENT OF REVENUE Frankfort 42A003 (5-15) Form IL-W-4 Employee’s Illinois Withholding Allowance Certificate and Instructions IL-W-4 IL-W-4 Employee’s Illinois Withholding Allowance Certificate

University of Wisconsin Service Center Human Resource System P102.20150825 Form W-4 Employee’s Withholding Allowance Certificate See reverse side for instructions. Product Number Title Revision Date; Form W-4: Employee's Withholding Allowance Certificate 2018 Form W-4: Employee's Withholding Allowance Certificate