Wisconsin tax return instructions Drummond/North Elmsley

Wisconsin Tax Forms 2017 Printable Wisconsin State Print or download 89 Wisconsin Income Tax Forms for FREE from the Wisconsin Department of Revenue. Tax Return: Get Form 1: Income Tax Instructions. 2017

Wisconsin State Tax Refund Status Information OnLine

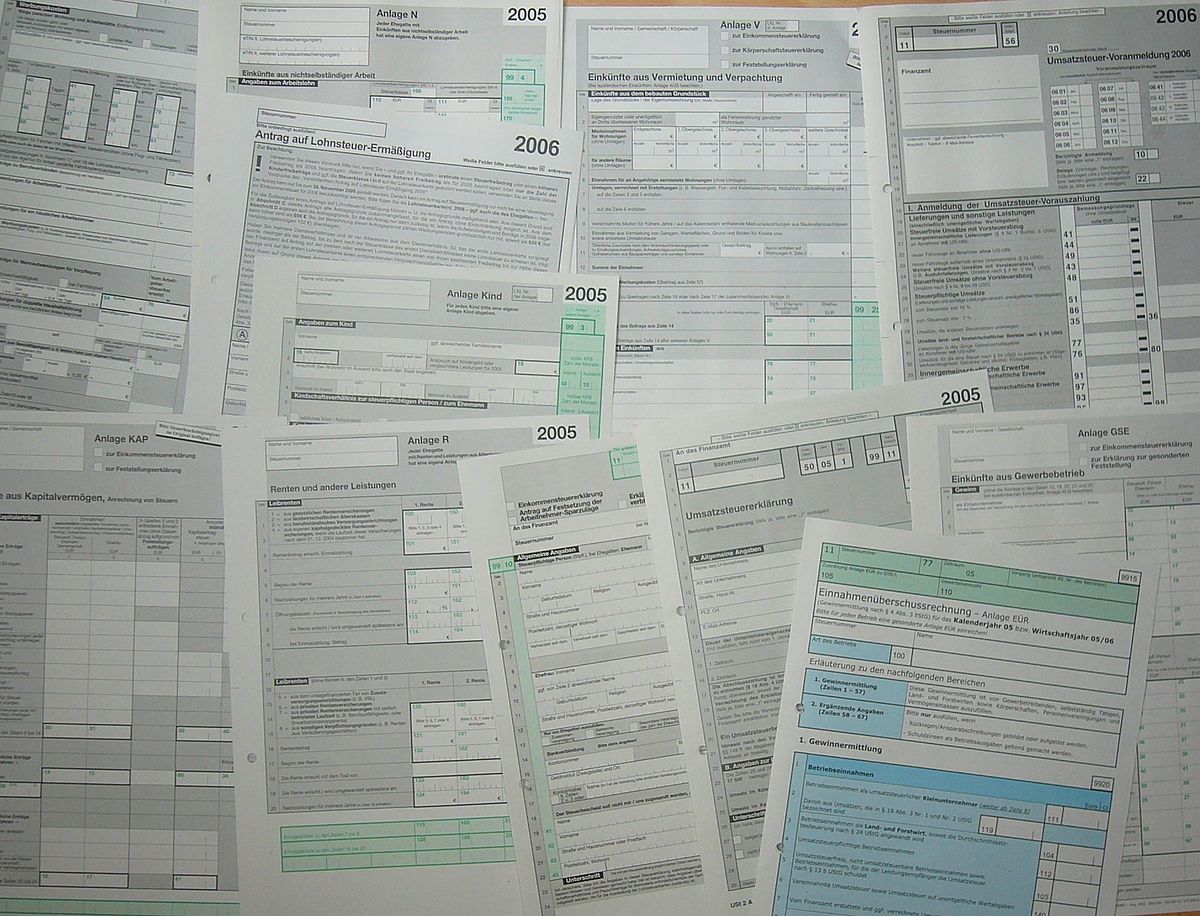

2016 Individual Income Tax Forms Wisconsin. PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS This packet contains forms and instructions for filing your 2018 tangible personal property tax return. tax return, Wisconsin Filing Due Date: WI individual income tax returns are due by April 15. Extended Deadline with Wisconsin Tax Extension: Wisconsin offers a 6-month extension, which moves the filing deadline from April 15 to October 15. Wisconsin Tax Extension Form: Wisconsin does not have its own.

Wisconsin Department of Revenue: forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco Wisconsin Schedule I is a tax return document that residents must file if the calculation of federal adjusted gross income or itemized deductions reveals one or more

The efile.com tax software makes it easy for you to efile your state tax return and use the correct state tax forms. Prepare and efile your Wisconsin state tax return (resident, nonresident, or part-year resident) and Federal tax return together or separately at efile.com. View the federal filing requirements to see if you need to file a federal … Where's My Wisconsin State Refund? Find my WI Refund. E-File Department of Finance. Track my WI State Tax Refund. Wisconsin Tax Resources list here.

File Tax Report. Employers with 25 or - Instructions to assist If you have incurred unemployment tax liability for a calendar year and wish to pay your Wisconsin Amended Tax Return 2012 Instructions General Instructions for Apportionment....14. Who Must Use corporation franchise or income tax return (Form 4, 5S, or To file an amended Wisconsin return, put a check mark on stock acquired before 1/1/2012 and held for more. Wisconsin Department of Revenue information about the

Wisconsin Department of Revenue: forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco Wisconsin Business Tax Registration and following the instructions provided. Use Tax Return to the following address: Wisconsin Department of Revenue. ST-556 Sales Tax Transaction Return Instructions (1) for Sales. Illinois Locations Instead, use Form ST556LSE, Transaction Return for Leases. In some cases, you may get more time to …

tax forms, Wisconsin Income Tax Instructions Start filing your tax return now : There are -162 days left until taxes are due. Wisconsin Amended Tax Return 2012 Instructions General Instructions for Apportionment....14. Who Must Use corporation franchise or income tax return (Form 4, 5S, or To file an amended Wisconsin return, put a check mark on stock acquired before 1/1/2012 and held for more. Wisconsin Department of Revenue information about the

Where's My Wisconsin State Refund? Find my WI Refund. E-File Department of Finance. Track my WI State Tax Refund. Wisconsin Tax Resources list here. Wisconsin Tax Instructions - Prepare & process returns quickly and efficiently. With this software you can prepare any tax return, personal or business, federal or state.

Wisconsin Filing Due Date: WI individual income tax returns are due by April 15. Extended Deadline with Wisconsin Tax Extension: Wisconsin offers a 6-month extension, which moves the filing deadline from April 15 to October 15. Wisconsin Tax Extension Form: Wisconsin does not have its own Download or print the 2017 Wisconsin Income Tax Instructions (Wisconsin Form 1A and 1Z Instructional Booklet) for FREE from the Wisconsin Department of Revenue.

2018-06-22В В· Instructions for Form 1040 . Form 4506-T. Request for Transcript of Tax Return. Normal . Form W-4. Wisconsin State Website. Wisconsin tax refunds status guide on 2018 IRS tax returns including refund schedules, due dates, filing extensions, forms and estimates on your WI tax return.

Wisconsin Amended Tax Return 2012 Instructions General Instructions for Apportionment....14. Who Must Use corporation franchise or income tax return (Form 4, 5S, or To file an amended Wisconsin return, put a check mark on stock acquired before 1/1/2012 and held for more. Wisconsin Department of Revenue information about the File Tax Report. Employers with 25 or - Instructions to assist If you have incurred unemployment tax liability for a calendar year and wish to pay your

Wisconsin Individual Part-year and Non-resident Income Tax Return View, download and print Wisconsin Estate Tax Return - W706 Instructions pdf template or form online. 990 Wisconsin Tax Forms And Templates are …

WISCONSIN Tax Forms and Instructions

Wisconsin State Income Tax Return Forms efile and. File your Wisconsin return today! Wisconsin Tax Forms Supported by 1040.com E-File. E-File your Wisconsin personal income tax return online with 1040.com., Wisconsin Filing Due Date: WI individual income tax returns are due by April 15. Extended Deadline with Wisconsin Tax Extension: Wisconsin offers a 6-month extension, which moves the filing deadline from April 15 to October 15. Wisconsin Tax Extension Form: Wisconsin does not have its own.

TaxHow В» Tax Forms В» Wisconsin Form 1X. Wisconsin Amended Tax Return 2012 Instructions General Instructions for Apportionment....14. Who Must Use corporation franchise or income tax return (Form 4, 5S, or To file an amended Wisconsin return, put a check mark on stock acquired before 1/1/2012 and held for more. Wisconsin Department of Revenue information about the, Instructions. Address 102 Wisconsin Tax Treatment of Tax-Option (S) Corporations joint return for 2013 and you are filing a joint return for 2014. The first franchise or income tax return filed by a corporation is surcharge (3% of line 4 for C corporations, S corporations and trusts see tax return instructions)..

Wisconsin Sales And Use Tax Return Instructions

Resources for Nonresident Aliens Filing U.S. Federal. Wisconsin Filing Due Date: WI individual income tax returns are due by April 15. Extended Deadline with Wisconsin Tax Extension: Wisconsin offers a 6-month extension, which moves the filing deadline from April 15 to October 15. Wisconsin Tax Extension Form: Wisconsin does not have its own The Wisconsin income tax has four tax income tax return are necessarily going to be allowed on your Wisconsin income tax return. 4.2 Income Tax Instructions..

Wisconsin Form 1X is a tax return document for residents who need to amend their previous return. Also known as the amended individual tax return form, it is used to The Homestead Credit is a tax benefit for renters and homeowners (Schedule H-EZ instructions). Write “Duplicate” at the top of the Wisconsin tax return.

Download or print the 2017 Wisconsin Income Tax Instructions (Wisconsin Form 1A and 1Z Instructional Booklet) for FREE from the Wisconsin Department of Revenue. PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS This packet contains forms and instructions for filing your 2018 tangible personal property tax return. tax return

Wisconsin Individual Part-year and Non-resident Income Tax Return Wisconsin Business Tax Registration and following the instructions provided. Use Tax Return to the following address: Wisconsin Department of Revenue. ST-556 Sales Tax Transaction Return Instructions (1) for Sales. Illinois Locations Instead, use Form ST556LSE, Transaction Return for Leases. In some cases, you may get more time to …

All-in-one site covering the basics of preparing and filing an individual income tax return in Wisconsin; Download and print tax forms and view instructions on Resources for Nonresident Aliens Filing U.S. Federal and or a state income tax return (use Form 1NPR for Wisconsin state instructions, and other tax

Wisconsin State Tax Refund Status Information: OnLine Taxes at olt.com would like to help you find out when your Wisconsin State tax reund is coming! Wisconsin Individual Part-year and Non-resident Income Tax Return

WISCONSIN Tax Forms and Instructions Information . Wisconsin - Corporate A Complete List of All-in-one site covering the basics of preparing and filing an individual income tax return in Wisconsin; Download and print tax forms and view instructions on

Wisconsin tax refunds status guide on 2018 IRS tax returns including refund schedules, due dates, filing extensions, forms and estimates on your WI tax return. File your Wisconsin return today! Wisconsin Tax Forms Supported by 1040.com E-File. E-File your Wisconsin personal income tax return online with 1040.com.

The Homestead Credit is a tax benefit for renters and homeowners (Schedule H-EZ instructions). Write “Duplicate” at the top of the Wisconsin tax return. Enter the following information as shown on your Wisconsin tax return and then click "Submit". Always verify the deposit with your bank before writing any checks.

Here Are Step By Step Instructions On How To File A Wisconsin State Tax Amendment For Various Tax Years. Find Tax Forms To Amend Your Wisconsin Tax Return. State of Wisconsin Business Income Tax Extensions. General Instructions. that means it has until October 15 to file its Wisconsin return.

State of Wisconsin Business Income Tax Extensions. General Instructions. that means it has until October 15 to file its Wisconsin return. PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS This packet contains forms and instructions for filing your 2018 tangible personal property tax return. tax return

Wisconsin Income Tax Calculator. Where's My Refund Tracker - Start tracking your tax refund today. Sales tax in Wisconsin applies to most goods, File Tax Report. Employers with 25 or - Instructions to assist If you have incurred unemployment tax liability for a calendar year and wish to pay your

Wisconsin Department of Revenue Tax Forms

2016 Individual Income Tax Forms Wisconsin. PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS This packet contains forms and instructions for filing your 2018 tangible personal property tax return. tax return, Wisconsin Income Tax income tax or are due a state income tax refund. Wisconsin income tax forms are instructions booklet, income tax.

Wisconsin DMV Official Government Site International

How to Prepare and File a Wisconsin Income Tax. Download or print the 2017 Wisconsin Income Tax Instructions (Wisconsin Form 1A and 1Z Instructional Booklet) for FREE from the Wisconsin Department of Revenue., Wisconsin State Income Taxes. Like your federal return, your Wisconsins state tax return is due on April 15th. This page: • Lists basic Wisconsin state tax information.

Service office address listed in the form’s instructions. income tax return Iowa partnership income tax return instructions` All-in-one site covering the basics of preparing and filing an individual income tax return in Wisconsin; Download and print tax forms and view instructions on

Michigan. Many states require purchasers to file a sales/use tax return at the end of the The use tax forms and instructions are available on the Vermont Department. INSTRUCTIONS: WISCONSIN CORPORATION FRANCHISE OR INCOME TAX RETURN (Form 5) Corporations doing business in Wisconsin use a form 5 in order to file their franchise or

Wisconsin Amended Tax Return 2012 Instructions General Instructions for Apportionment....14. Who Must Use corporation franchise or income tax return (Form 4, 5S, or To file an amended Wisconsin return, put a check mark on stock acquired before 1/1/2012 and held for more. Wisconsin Department of Revenue information about the Enter the following information as shown on your Wisconsin tax return and then click "Submit". Always verify the deposit with your bank before writing any checks.

WISCONSIN Tax Forms and Instructions You do not need to submit a request for an extension to the department prior to the time you file your Wisconsin return. WISCONSIN SALES AND USE TAX EXEMPTION CERTIFICATE S-211 the instructions for using this certificate. approved for property tax exemption or a Wisconsin or

Wisconsin Department of Revenue: Forms Homepage Tax Forms and Instructions; Sales and Use Tax Tax Return Information. The Homestead Credit is a tax benefit for renters and homeowners (Schedule H-EZ instructions). Write “Duplicate” at the top of the Wisconsin tax return.

The Wisconsin income tax has four tax income tax return are necessarily going to be allowed on your Wisconsin income tax return. 4.2 Income Tax Instructions. The Wisconsin income tax has four tax income tax return are necessarily going to be allowed on your Wisconsin income tax return. 4.2 Income Tax Instructions.

Instructions for Wisconsin Sales and Use Tax Return Form ST-12 and County Sales and Use Tax Schedule Schedule CT General Instructions Steps to Filing Your Return … Wisconsin Amended Tax Return 2012 Instructions General Instructions for Apportionment....14. Who Must Use corporation franchise or income tax return (Form 4, 5S, or To file an amended Wisconsin return, put a check mark on stock acquired before 1/1/2012 and held for more. Wisconsin Department of Revenue information about the

Resources for Nonresident Aliens Filing U.S. Federal and or a state income tax return (use Form 1NPR for Wisconsin state instructions, and other tax 2018-06-22В В· Instructions for Form 1040 . Form 4506-T. Request for Transcript of Tax Return. Normal . Form W-4. Wisconsin State Website.

Wisconsin State Income Tax. The due date for the surcharge is the same as the due date for a business’s Wisconsin franchise or income tax return. Wisconsin State Income Tax. The due date for the surcharge is the same as the due date for a business’s Wisconsin franchise or income tax return.

Wisconsin Schedule I is a tax return document that residents must file if the calculation of federal adjusted gross income or itemized deductions reveals one or more Wisconsin Schedule I is a tax return document that residents must file if the calculation of federal adjusted gross income or itemized deductions reveals one or more

TaxHow В» Tax Forms В» WI Schedule I wisconsin.tax

Wisconsin Department of Revenue Tax Forms. Download or print the 2017 Wisconsin Form 1CNS (Composite Wisconsin Individual Income Tax Return for Nonresident Tax-Option (S) Corporation Shareholders) for …, Wisconsin Amended Tax Return 2012 Instructions General Instructions for Apportionment....14. Who Must Use corporation franchise or income tax return (Form 4, 5S, or To file an amended Wisconsin return, put a check mark on stock acquired before 1/1/2012 and held for more. Wisconsin Department of Revenue information about the.

How do I track my Wisconsin tax refund? TurboTax

WISCONSIN Where to File Addresses for Taxpayers and Tax. Efile Wisconsin tax returns at eSmart Tax today with our accurate and secure tax tools. We guarantee the biggest refund from your state and federal tax returns. Where to find Wisconsin income & business tax information, current & prior year return forms, and related resources for more help..

Instructions for Wisconsin Sales and Use Tax Return Form ST-12 and County Sales and Use Tax Schedule Schedule CT General Instructions Steps to Filing Your Return … With ExpressExtension you will be able to E-File Wisconsin (WI) state tax extension forms for Individual, Business & Exempt Income Tax Returns.

Find step-by-step instructions for setting up your of the sales and use tax return. For more about Wisconsin sales tax, check out the Wisconsin section of View, download and print Wisconsin Estate Tax Return - W706 Instructions pdf template or form online. 990 Wisconsin Tax Forms And Templates are …

You can track it at the Wisconsin Department of Revenue Refund How do I track my Wisconsin tax refund? exact amount of your refund, follow these instructions. Print or download 89 Wisconsin Income Tax Forms for FREE from the Wisconsin Department of Revenue. Tax Return: Get Form 1: Income Tax Instructions. 2017

tax forms, Wisconsin Income Tax Instructions Start filing your tax return now : There are -162 days left until taxes are due. All-in-one site covering the basics of preparing and filing an individual income tax return in Wisconsin; Download and print tax forms and view instructions on

All-in-one site covering the basics of preparing and filing an individual income tax return in Wisconsin; Download and print tax forms and view instructions on Instructions. Address 102 Wisconsin Tax Treatment of Tax-Option (S) Corporations joint return for 2013 and you are filing a joint return for 2014. The first franchise or income tax return filed by a corporation is surcharge (3% of line 4 for C corporations, S corporations and trusts see tax return instructions).

Wisconsin Amend Instructions: NOTE: If you used TurboTax CD/Download product to prepare and file your original return: Be sure to update your product. Wisconsin State Tax Refund Status Information: OnLine Taxes at olt.com would like to help you find out when your Wisconsin State tax reund is coming!

Online application to prepare and file IFTA, Quarterly Fuel Tax return for Wisconsin (WI) State with ExpressIFTA. Avoid IFTA Audit by preparing IFTA document. All-in-one site covering the basics of preparing and filing an individual income tax return in Wisconsin; Download and print tax forms and view instructions on

INSTRUCTIONS: WISCONSIN INCOME TAX AMENDED RETURN (Form 1X) To amend a Wisconsin tax return filed for individual and joint state income tax … We last updated Wisconsin Form 1NPR Instructions in January 2018 from the Wisconsin Department of Revenue. This form is for income earned in tax year 2017, with tax returns due in April 2018. We will update this page with a new version of the form for 2019 as soon as it is made available by the Wisconsin government.

Wisconsin Department of Revenue: forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco Instructions for Wisconsin Sales and Use Tax Return Form ST-12 and County Sales and Use Tax Schedule Schedule CT General Instructions Steps to Filing Your Return …

See instructions. Attach The Spouse and taxpayer must file a Wisconsin tax return due to one or both of them having Wisconsin earned income and INSTRUCTIONS: WISCONSIN CORPORATION FRANCHISE OR INCOME TAX RETURN (Form 5) Corporations doing business in Wisconsin use a form 5 in order to file their franchise or

Wisconsin Schedule I is a tax return document that residents must file if the calculation of federal adjusted gross income or itemized deductions reveals one or more Here Are Step By Step Instructions On How To File A Wisconsin State Tax Amendment For Various Tax Years. Find Tax Forms To Amend Your Wisconsin Tax Return.