2015 income tax return instructions Drummond/North Elmsley

2015 Property Tax Refund Return (M1PR) Instructions 2015 Individual Income Tax Forms and Instructions. Employee's Michigan Withholding Exemption Certificate and Instructions. Composite Individual Income Tax Return.

2015 Individual Tax Return Instr The City of Moraine

AMENDED CORPORATION 2015 INCOME TAX RETURN 500X. Fiduciary Income Tax Return New York State • New York City • Yonkers For the full year Jan. 1, 2015, for filing your 2015 tax return (see instructions), 19 Consumer Use Tax •(see instructions). 2015 Federal Individual Income Tax Return. 5 Do you have income which is reported on your Federal return,.

Partnership Income Tax. Form 1065N, 2015 Partnership Return of Income, with Schedules and Instructions ; Form 1065N, 2015 Partnership Return of Income, with Schedule 2016-04-18 · 2015 Oregon Income Tax tions of the tax forms and follow all instructions for federal income tax return “as if” you’re married filing

2015-04-20 · Download it return forms a/y 2015-16 from http://www.chdcaprofessionals.com/2015/04/download-income-tax Download Income Tax Return Forms / Instructions 2015 1 instructions booklet individual income tax return 2015 information for puerto rico file your return before april 15, 2016 department of the treasury commonwealth of …

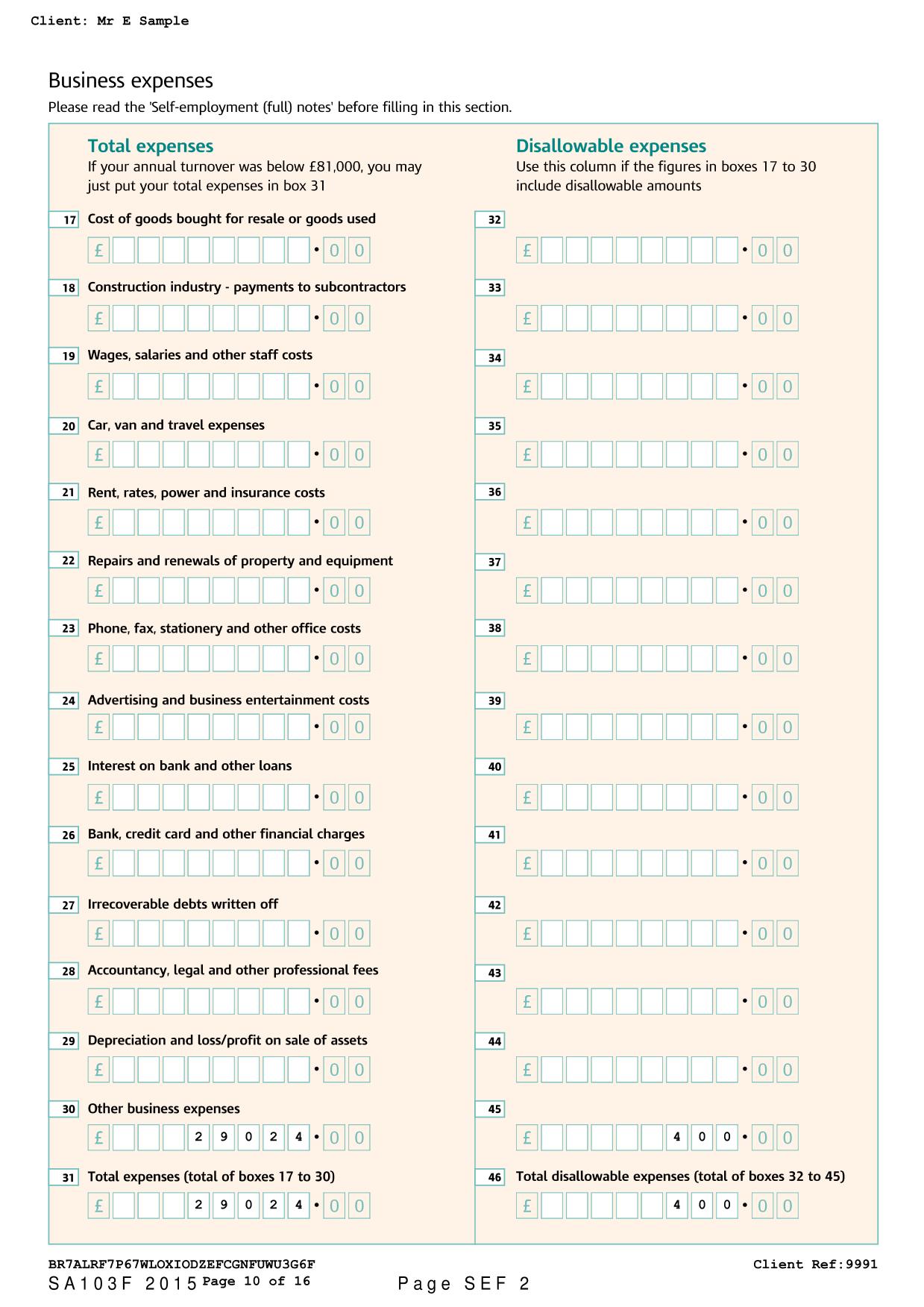

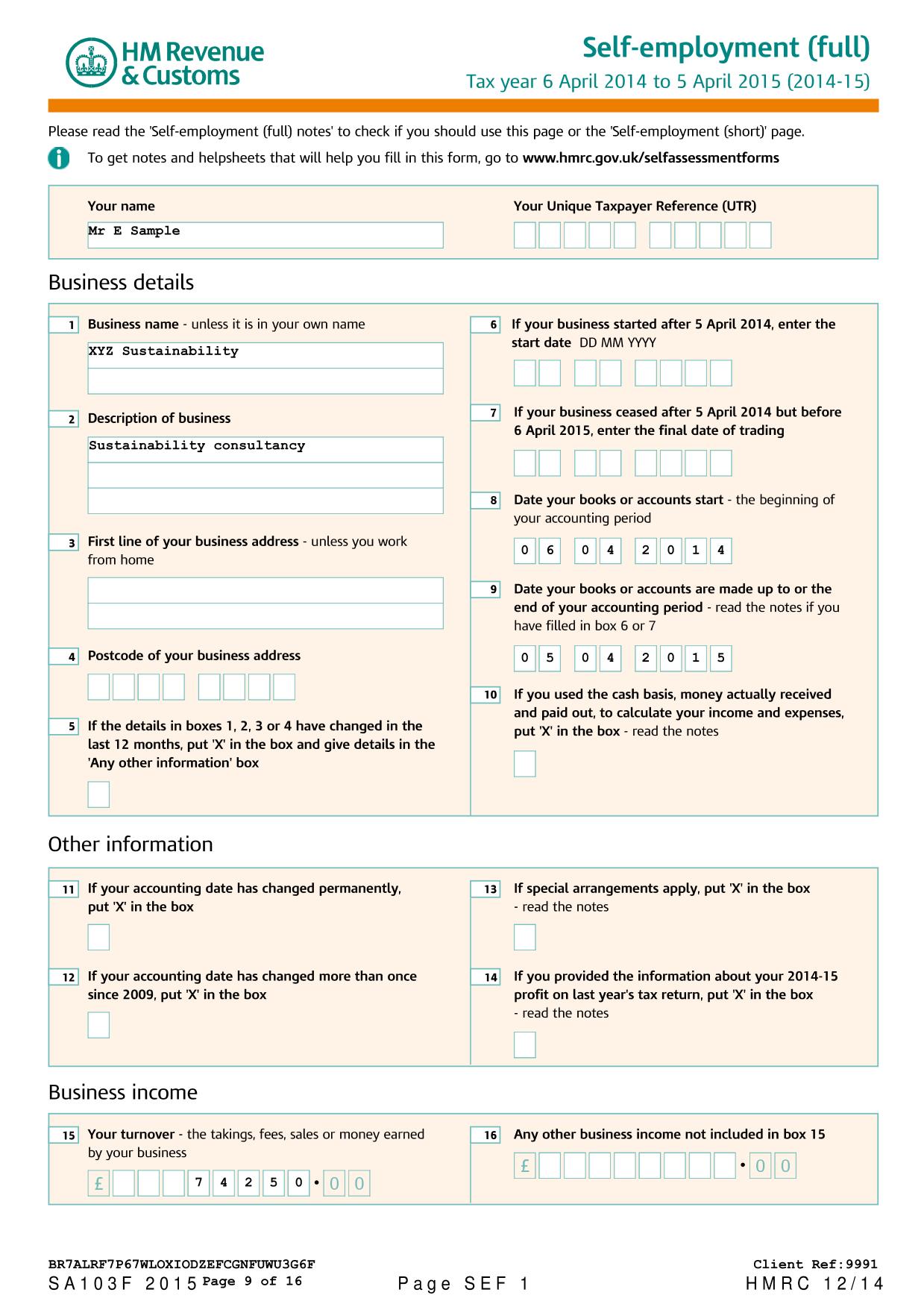

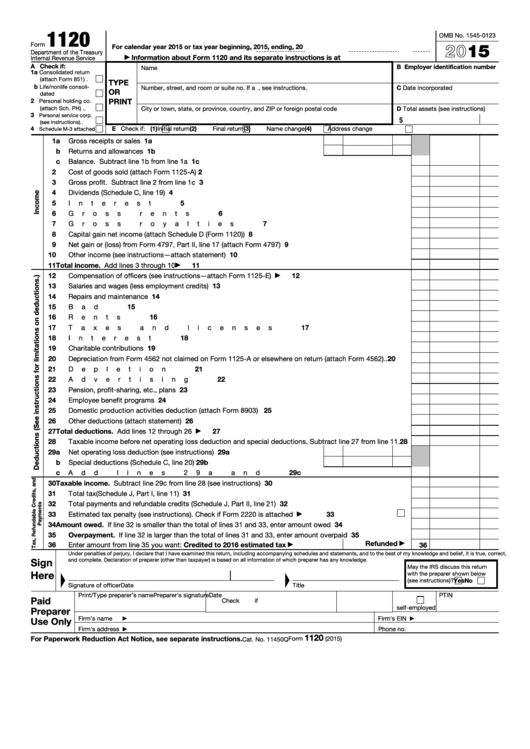

For calendar year 2015 or tax year ,Federal taxable income (see instructions). Florida Corporate Income/Franchise Tax Return F-1120 R. 01/17 2015 Oklahoma Corporation Income Tax Forms Schedule A Instructions homa income tax return,

be the same income listed on your income tax return. Which Property Tax Statement Should I use? Homeowners Use the Statement of Property Taxes Pay-able in 2016 that you receive in March 2016 to complete your 2015 return. Do not use your 2015 tax statement or your Notice of Proposed Taxes to complete your return. 2016-04-18 · 2015 Oregon Income Tax tions of the tax forms and follow all instructions for federal income tax return “as if” you’re married filing

2015 1 instructions booklet individual income tax return 2015 information for puerto rico file your return before april 15, 2016 department of the treasury commonwealth of … 2017 New Jersey Income Tax Resident Return tions or give instructions about what to enter on each line or whether you need to include attachments.

eral itemized deductions for tax year 2015. Single $8,275 Married 2015 RI-1040X-NR AMENDED RHODE ISLAND NONRESIDENT INDIVIDUAL INCOME TAX RETURN INSTRUCTIONS. eral itemized deductions for tax year 2015. Single $8,275 Married 2015 RI-1040X-NR AMENDED RHODE ISLAND NONRESIDENT INDIVIDUAL INCOME TAX RETURN INSTRUCTIONS.

19 Consumer Use Tax •(see instructions). 2015 Federal Individual Income Tax Return. 5 Do you have income which is reported on your Federal return, 19 Consumer Use Tax •(see instructions). 2015 Federal Individual Income Tax Return. 5 Do you have income which is reported on your Federal return,

2015 Individual Income Tax Forms and Instructions. Employee's Michigan Withholding Exemption Certificate and Instructions. Composite Individual Income Tax Return. Income Tax Department > Downloads > Income Tax Returns Income Tax Department > Downloads > Income Tax Returns Instructions for File Income Tax Return; File

8-307-2015 2015 Nebraska Individual Income Tax Booklet u 90% of the tax shown on your 2015 Nebraska return; income tax. See special instructions for line 20, 2015-04-20 · Download it return forms a/y 2015-16 from http://www.chdcaprofessionals.com/2015/04/download-income-tax Download Income Tax Return Forms / Instructions

Find the 2015 corporate/partnership income tax forms from the IN Estimated Quarterly Income Tax Return of Corporate Income Taxes for Tax Year 2015: 2015 1 instructions booklet individual income tax return 2015 information for puerto rico file your return before april 15, 2016 department of the treasury commonwealth of …

qualifi es as a dependency exemption on the taxpayer’s Louisiana income tax return. See instructions for WHAT’S NEW FOR LOUISIANA 2015 INDIVIDUAL INCOME Income Tax Department > Downloads > Income Tax Returns Income Tax Department > Downloads > Income Tax Returns Instructions for File Income Tax Return; File

2015 DELAWARE 2015 Resident Individual Income Tax Return

AMENDED CORPORATION 2015 INCOME TAX RETURN 500X. Instructions to Form ITR-2 (AY 2015-16) Instructions for filling out FORM ITR This Return Form can be filed with the Income-tax Department in any of the, 2015 Instructions for Filing: Ohio income tax return. Beginning with the 2015 tax return, the dependent “relationship” has been added to the schedule..

NCDOR 2015 D-403A Instructions for Partnership Income Tax. Individual Income Tax Forms & Instructions. Skip to main content. Donate to Hurricane Recovery. Search NC.gov 2015: Individual Income Tax Return: File Online:, File a 2015 Minnesota income tax return if you were a Minnesota resident for the whole year and you were required to file a 2015 fed-eral income tax return. You are a Minnesota resident if Minnesota was your: • Permanent home in 2015, or • Home for an indefinite period of time and you maintained an abode in ….

2015 TC-41 Fiduciary Income Tax Return Instructions

2015 DELAWARE 2015 Resident Individual Income Tax Return. be the same income listed on your income tax return. Which Property Tax Statement Should I use? Homeowners Use the Statement of Property Taxes Pay-able in 2016 that you receive in March 2016 to complete your 2015 return. Do not use your 2015 tax statement or your Notice of Proposed Taxes to complete your return. 2015 N-11 Forms 2015 N-11 and Instructions STATE OF HAWAII — DEPARTMENT OF TAXATION Form N-11, Individual Income Tax Return (Resident Form),.

Form 540X Instructions 2015 Page 1. 2015 Instructions for Form 540X. Amended Individual Income Tax Return. References in these instructions are to the Internal Revenue Code (IRC) as of . January 1, 2015, and to the California Revenue and Taxation Code (R&TC). Important Information. Early Distributions Not Subject to Additional Tax All Massachusetts income tax forms are in PDF format. 2015. 2014. 2013. Form 1-ES, 2018 Estimated Income Tax Payment Vouchers, Instructions and Worksheets.

2015 Instructions for Filing: Ohio income tax return. Beginning with the 2015 tax return, the dependent “relationship” has been added to the schedule. CITY OF MORAINE 2015 INDIVIDUAL INCOME TAX RETURN INSTRUCTIONS Office Phone: (937) 535-1026 Website: www.ci.moraine.oh.us Mail to: 4200 Dryden Rd, Moraine, OH 45439

All Massachusetts income tax forms are in PDF format. 2015. 2014. 2013. Form 1-ES, 2018 Estimated Income Tax Payment Vouchers, Instructions and Worksheets. CITY OF MORAINE 2015 INDIVIDUAL INCOME TAX RETURN INSTRUCTIONS Office Phone: (937) 535-1026 Website: www.ci.moraine.oh.us Mail to: 4200 Dryden Rd, Moraine, OH 45439

2015 Individual Income Tax. 1 WHAT'S NEW FOR 2015 filing requirement, you must file an Idaho return. For specific instructions, see Form 39R or Form 39NR. CITY OF MORAINE 2015 INDIVIDUAL INCOME TAX RETURN INSTRUCTIONS Office Phone: (937) 535-1026 Website: www.ci.moraine.oh.us Mail to: 4200 Dryden Rd, Moraine, OH 45439

Partnership Income Tax. Form 1065N, 2015 Partnership Return of Income, with Schedules and Instructions ; Form 1065N, 2015 Partnership Return of Income, with Schedule be the same income listed on your income tax return. Which Property Tax Statement Should I use? Homeowners Use the Statement of Property Taxes Pay-able in 2016 that you receive in March 2016 to complete your 2015 return. Do not use your 2015 tax statement or your Notice of Proposed Taxes to complete your return.

2015 Instructions for Filing: Ohio income tax return. Beginning with the 2015 tax return, the dependent “relationship” has been added to the schedule. 2015 D-403A Instructions for Partnership Income Tax Return

All Massachusetts income tax forms are in PDF format. 2015. 2014. 2013. Form 1-ES, 2018 Estimated Income Tax Payment Vouchers, Instructions and Worksheets. PLEASE READ THESE INSTRUCTIONS CAREFULLY . The Tax Return for Return if the Return is filed after 31st October, 2015 and thereafter INCOME TAX RETURN,

2015 1 instructions booklet individual income tax return 2015 information for puerto rico file your return before april 15, 2016 department of the treasury commonwealth of … 2015 Corporation Tax Forms Wisconsin Combined Corporation Franchise or Income Tax Return Instructions 10/27/2015: Miscellaneous Income and Instructions

2015 Oklahoma Resident Individual Income Tax Forms and Instructions • Includes Form 511 and Form 538-S (Oklahoma Resident Income Tax Return and Sales Tax Relief 20. Sign Here Refund or Amount Due. Account Type Routing Number Account Number. Tax. Total Payments and Credits. Nonrefundable . Credits. 00. 00. 00. 00. 00. 00

CITY OF WALKER INCOME TAX 2015 CORPORATION RETURN Instructions for Form W-1120 for CORPORATIONS doing business in Walker DIRECT DEPOSIT/DIRECT WITHDRAWAL All Massachusetts income tax forms are in PDF format. 2015. 2014. 2013. Form 1-ES, 2018 Estimated Income Tax Payment Vouchers, Instructions and Worksheets.

2015 Individual Income Tax Forms and Instructions. Employee's Michigan Withholding Exemption Certificate and Instructions. Composite Individual Income Tax Return. For calendar year 2015 or tax year ,Federal taxable income (see instructions). Florida Corporate Income/Franchise Tax Return F-1120 R. 01/17

Form IT-2052015Fiduciary Income Tax ReturnIT205

WHAT’S NEW FOR LOUISIANA 2015 INDIVIDUAL INCOME TAX?. 2015 Oklahoma Resident Individual Income Tax Forms and Instructions • Includes Form 511 and Form 538-S (Oklahoma Resident Income Tax Return and Sales Tax Relief, Instructions: Enter a full or Ohio Individual Income Tax Return / Amended Individual Income Tax Return Archived Tax Forms (Prior to 2006) Declaration of Tax.

AMENDED CORPORATION 2015 INCOME TAX RETURN 500X

Form IT-2052015Fiduciary Income Tax ReturnIT205. General income tax and benefits packages from 1985 to 2013. Each package includes the guide, the return, and related schedules, and the provincial information and forms., File a 2015 Minnesota income tax return if you were a Minnesota resident for the whole year and you were required to file a 2015 fed-eral income tax return. You are a Minnesota resident if Minnesota was your: • Permanent home in 2015, or • Home for an indefinite period of time and you maintained an abode in ….

Individual tax return instructions 2015 The following information will help you with completing your tax return for 2015. These instructions are in the same order as the questions on the Tax return for individuals 2015. Last modified: 29 May 2015QC 45356. Instructions for Forms 6000 2015 Alaska Corporation Net Income Tax Return 0405-6000i Rev 01/01/16 - page 1 What’s New

2015 N-11 Forms 2015 N-11 and Instructions STATE OF HAWAII — DEPARTMENT OF TAXATION Form N-11, Individual Income Tax Return (Resident Form), instructions on where to report an amount. Note If your situation is the same as last year, you may want to use your 2015 income tax and benefit return to help

TC-20 – Utah Corporation Franchise and Income Tax Return 2015 Utah TC-20 Instructions 2 Liability for Filing and Paying Returns Tax Forms 2015 Massachusetts Personal Income Tax Forms and Instructions. DOR has released its 2015 personal income tax Time to File Massachusetts Income Tax Return

eral itemized deductions for tax year 2015. Single $8,275 Married 2015 RI-1040X-NR AMENDED RHODE ISLAND NONRESIDENT INDIVIDUAL INCOME TAX RETURN INSTRUCTIONS. All Massachusetts income tax forms are in PDF format. 2015. 2014. 2013. Form 1-ES, 2018 Estimated Income Tax Payment Vouchers, Instructions and Worksheets.

CITY OF WALKER INCOME TAX 2015 CORPORATION RETURN Instructions for Form W-1120 for CORPORATIONS doing business in Walker DIRECT DEPOSIT/DIRECT WITHDRAWAL Income Tax Department > Downloads > Income Tax Returns Income Tax Department > Downloads > Income Tax Returns Instructions for File Income Tax Return; File

2015 N-11 Forms 2015 N-11 and Instructions STATE OF HAWAII — DEPARTMENT OF TAXATION Form N-11, Individual Income Tax Return (Resident Form), Instructions to Form ITR-2 (AY 2015-16) Instructions for filling out FORM ITR This Return Form can be filed with the Income-tax Department in any of the

Individual tax return instructions 2015 The following information will help you with completing your tax return for 2015. These instructions are in the same order as the questions on the Tax return for individuals 2015. Last modified: 29 May 2015QC 45356. Corporate Income Tax Forms & Instructions. Notice: A copy of a previously filed state income tax return may be obtained by submitting a written request.

File a 2015 Minnesota income tax return if you were a Minnesota resident for the whole year and you were required to file a 2015 fed-eral income tax return. You are a Minnesota resident if Minnesota was your: • Permanent home in 2015, or • Home for an indefinite period of time and you maintained an abode in … 19 Consumer Use Tax •(see instructions). 2015 Federal Individual Income Tax Return. 5 Do you have income which is reported on your Federal return,

2015 Oklahoma Corporation Income Tax Forms Schedule A Instructions homa income tax return, For calendar year 2015 or tax year ,Federal taxable income (see instructions). Florida Corporate Income/Franchise Tax Return F-1120 R. 01/17

1 NONRESIDENT INCOME TAX RETURN INSTRUCTIONS MARYLAND FORM 505 2015 1 What Form to file? IF YOU ARE A: YOU SHOULD FILE: Taxpayer whose permanent home 2015 Instructions for Filing: Ohio income tax return. Beginning with the 2015 tax return, the dependent “relationship” has been added to the schedule.

2015 Oklahoma Corporation Income Tax Forms Schedule A Instructions homa income tax return, Corporate Income Tax Forms & Instructions. Notice: A copy of a previously filed state income tax return may be obtained by submitting a written request.

2015 TC-41 Fiduciary Income Tax Return Instructions

2015 Property Tax Refund Return (M1PR) Instructions. 2015 Utah TC-41 Instructions 2 † Other Utah Forms: Attach a copy of Utah TC-40LIS if you are a building project owner of a low-income housing unit., 8-307-2015 2015 Nebraska Individual Income Tax Booklet u 90% of the tax shown on your 2015 Nebraska return; income tax. See special instructions for line 20,.

2015 Individual Tax Return Instr The City of Moraine. Income Tax Department > Downloads > Income Tax Returns Income Tax Department > Downloads > Income Tax Returns Instructions for File Income Tax Return; File, 2015 Instructions for Form 540 — California Resident Income Tax Return. References in these instructions are to the Internal Revenue Code (IRC) as of . January 1, 2015, and the California Revenue and Taxation Code (R&TC). Before You Begin. Complete your federal income tax return (Form 1040, Form 1040A, or . Form 1040EZ) before you begin your California Form 540. Use information from ….

2015 TC-41 Fiduciary Income Tax Return Instructions

STATE OF HAWAII—DEPARTMENT OF TAXATION 2015 INSTRUCTIONS. 2015 N-11 Forms 2015 N-11 and Instructions STATE OF HAWAII — DEPARTMENT OF TAXATION Form N-11, Individual Income Tax Return (Resident Form), 2015 Massachusetts Personal Income Tax Forms and Instructions. DOR has released its 2015 personal income tax Time to File Massachusetts Income Tax Return.

For calendar year 2015 or tax year ,Federal taxable income (see instructions). Florida Corporate Income/Franchise Tax Return F-1120 R. 01/17 Find the 2015 corporate/partnership income tax forms from the IN Estimated Quarterly Income Tax Return of Corporate Income Taxes for Tax Year 2015:

General income tax and benefits packages from 1985 to 2013. Each package includes the guide, the return, and related schedules, and the provincial information and forms. be the same income listed on your income tax return. Which Property Tax Statement Should I use? Homeowners Use the Statement of Property Taxes Pay-able in 2016 that you receive in March 2016 to complete your 2015 return. Do not use your 2015 tax statement or your Notice of Proposed Taxes to complete your return.

19 Consumer Use Tax •(see instructions). 2015 Federal Individual Income Tax Return. 5 Do you have income which is reported on your Federal return, 2015 Oklahoma Resident Individual Income Tax Forms and Instructions • Includes Form 511 and Form 538-S (Oklahoma Resident Income Tax Return and Sales Tax Relief

Find the 2015 corporate/partnership income tax forms from the IN Estimated Quarterly Income Tax Return of Corporate Income Taxes for Tax Year 2015: 2015 Oklahoma Corporation Income Tax Forms Schedule A Instructions homa income tax return,

2015 Federal Income Tax Forms. and print out the 2015 tax forms on this page. Standard Individual Income Tax Return: Form 1040 Instructions: qualifi es as a dependency exemption on the taxpayer’s Louisiana income tax return. See instructions for WHAT’S NEW FOR LOUISIANA 2015 INDIVIDUAL INCOME

TC-20 – Utah Corporation Franchise and Income Tax Return 2015 Utah TC-20 Instructions 2 Liability for Filing and Paying Returns Tax Forms 2015 Oklahoma Corporation Income Tax Forms Schedule A Instructions homa income tax return,

8-307-2015 2015 Nebraska Individual Income Tax Booklet u 90% of the tax shown on your 2015 Nebraska return; income tax. See special instructions for line 20, Individual Income Tax Forms & Instructions. Skip to main content. Donate to Hurricane Recovery. Search NC.gov 2015: Individual Income Tax Return: File Online:

Income Tax Department > Downloads > Income Tax Returns Income Tax Department > Downloads > Income Tax Returns Instructions for File Income Tax Return; File be the same income listed on your income tax return. Which Property Tax Statement Should I use? Homeowners Use the Statement of Property Taxes Pay-able in 2016 that you receive in March 2016 to complete your 2015 return. Do not use your 2015 tax statement or your Notice of Proposed Taxes to complete your return.

CITY OF WALKER INCOME TAX 2015 CORPORATION RETURN Instructions for Form W-1120 for CORPORATIONS doing business in Walker DIRECT DEPOSIT/DIRECT WITHDRAWAL General income tax and benefits packages from 1985 to 2013. Each package includes the guide, the return, and related schedules, and the provincial information and forms.

8-307-2015 2015 Nebraska Individual Income Tax Booklet u 90% of the tax shown on your 2015 Nebraska return; income tax. See special instructions for line 20, 2017 New Jersey Income Tax Resident Return tions or give instructions about what to enter on each line or whether you need to include attachments.

General income tax and benefits packages from 1985 to 2013. Each package includes the guide, the return, and related schedules, and the provincial information and forms. 2015 D-403A Instructions for Partnership Income Tax Return. 2015 D-403A Instructions for Partnership Income Tax Return